Then there are six credit card charges that you may not be aware of in 2022.

This is a list of six credit card scams you should be aware of.

Credit cards are considered as both a blessing and a curse in today's world. Having a credit card could help you save money. However, if it isn't used properly, it can jam debt with new freights, negatively impacting your financial investments. Credit card behaviour, like loan prepayment, is an important part of a credit score that helps to build a person's CIBIL score. The CIBIL Score makes it easier to get bank loans and huge amounts of credit.

Credit cards, on the other hand, are not free, contrary to popular belief. There could be charges on your credit card that the bank doesn't reveal. Experts recommend that these little-known freights be studied to avoid forfeitures, late freights, and exorbitant interest rates.

Among the charges that could be added to your credit card are:

There could be charges on your credit card that the bank doesn't reveal. Experts recommend that these little-known freights be studied to avoid forfeitures, late freights, and exorbitant interest rates.

1. Periodic Conservation Diagram

Credit cards are charged with a joining figure and a periodic conservation figure. If you are provided a free credit card, the bank will waive the operation cost and monthly number for a specific length of time. Most banks are currently waiving the joining fee for the first time and charging it from then on. If you spend a specific amount, certain banks will waive these fees.

2. Interested Freights

Banks commonly impose an annual interest rate of 3-4 percent on the amount outstanding, with a periodic interest rate of 36 to 48 percent, which is quite valuable. Credit cards provide you 45-50 days to pay off any bills without paying interest. If the payment is not made on time, an interest rate is applied. If the entire payment is not made on time after the interest-free term has elapsed, however, banks charge the cardholder interest.

3. Recessionary freight for ATMs

Although cardholders can withdraw plutocracy from ATMs using their credit cards, such deals avoid new freights. Freights account for roughly 2.5% of all cash obtained from ATMs. Cash interest is compounded daily beginning on the date of withdrawal and ranges between 36 and 48 percent per year. As a result, experts recommend withdrawing cash from ATMs using credit cards only in an emergency.

4. The Late Payment Figure

If a customer fails to pay the minimum due amount on time, the bank will charge a new late payment fee. These charges apply if the payment is made after the deadline. These freights, on the other hand, are a one-time cost that has nothing to do with the amount of interest paid. Along with late payment fees, the cardholder's credit score is also hurt, so do everything you can to help it.

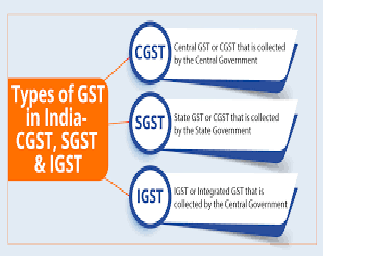

5. GST (Goods and Services Tax) in the India

At the present rates, all credit card transactions are subject to GST. Credit card-related services were subject to a 15 service duty prior to the introduction of GST. There has been a 3 increase since the implementation of GST, bringing the total to 18.

6. Figure of overdraft (O/ D).

Overdraft fees apply when a credit card member exceeds their yearly credit limit.

Finance Levies,India.gov.in,India.gov.in,India.gov.in,India.gov.in,India.gov.in,India.gov.in,India.gov.in,

No comments:

Post a Comment